Online Loans Made Easy: Your Ultimate Service for Urgent Money Requirements

Online financings have actually emerged as a feasible service for people facing immediate cash demands, providing a structured process that assures efficiency and access. The benefits and possible pitfalls of on the internet financings produce an engaging landscape that requires expedition for anyone looking for economic support in times of seriousness.

Advantages of Online Loans

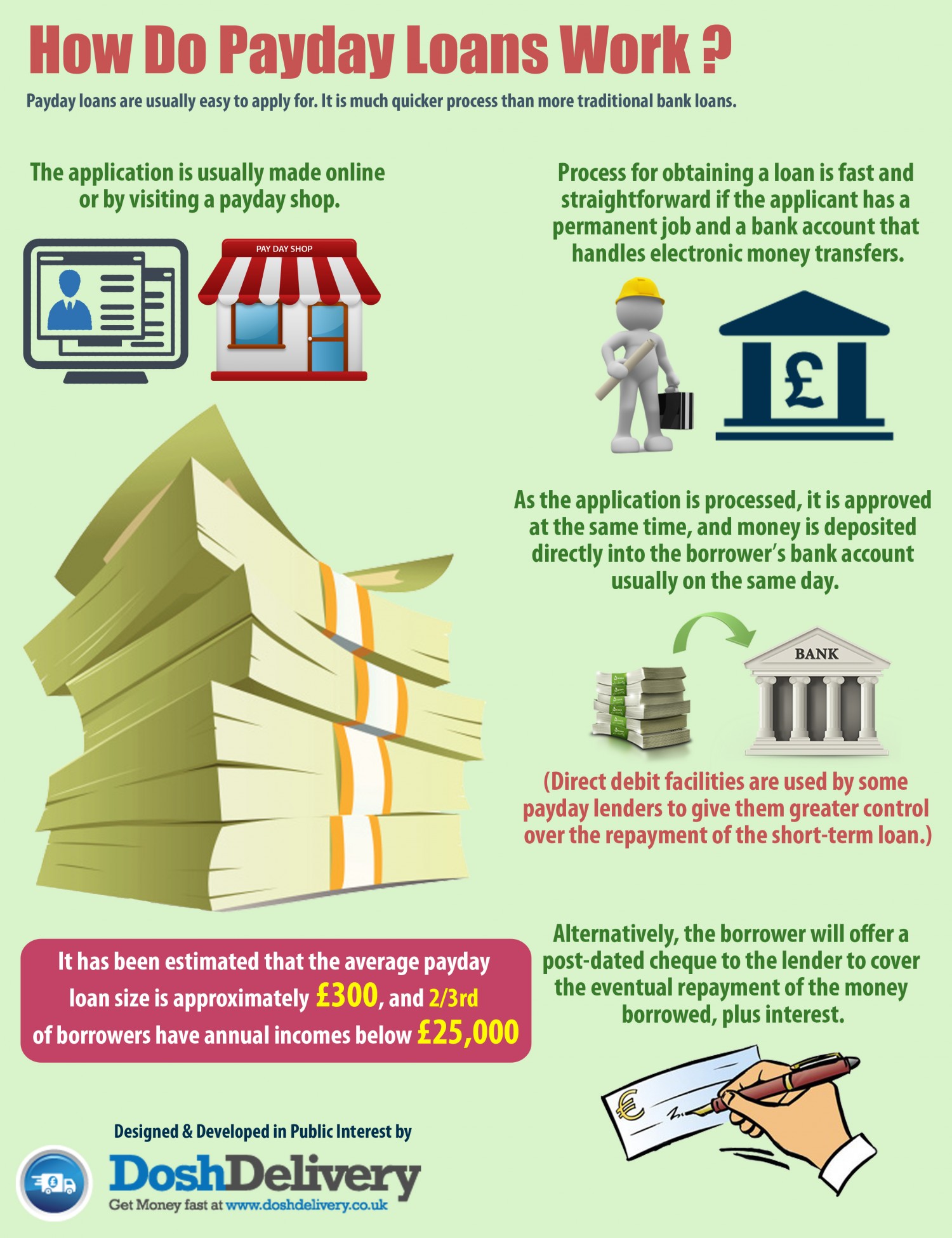

On-line car loans supply a convenient and efficient means for individuals to gain access to monetary aid without the need for conventional in-person interactions. Unlike standard loans that may take weeks to authorize, on the internet finances usually provide instant decisions, allowing customers to address their financial needs quickly.

One more advantage of on-line fundings is the ease of application. Borrowers can finish car loan applications from the comfort of their very own homes, getting rid of the need to see a physical bank or economic organization.

Eligibility and Application Refine

Speedy Approval and Disbursement

Efficient authorization processes and rapid dispensation of funds are crucial functions of online financings that provide to the instant financial demands of customers. Unlike traditional financial institution finances that might take weeks to process, on-line loan providers utilize innovative innovation to improve the approval procedure.

Contrast With Traditional Financing

Unlike the structured authorization procedures and rapid fund disbursement seen in on the internet finances, traditional financing techniques commonly entail more prolonged application processing times and funding delays. When getting a financing via traditional means, such as banks or cooperative credit union, borrowers frequently deal with a tiresome procedure that consists of submitting considerable documentation, giving security, and undergoing comprehensive credit history checks. This can lead to days or perhaps weeks of waiting on approval and ultimate dispensation of funds, which may not be ideal for people in immediate demand of cash money.

Furthermore, conventional loan providers tend to have stricter eligibility criteria, making it testing for people with less-than-perfect credit report or those doing not have substantial properties to protect a car he said loan - personal loans calgary. On the various other hand, on-line lending institutions, leveraging innovation and alternate data sources, have actually made it feasible for a larger variety of borrowers to accessibility fast and easy funding solutions. By streamlining the application procedure and accelerating approval times, on the internet fundings provide a practical alternative to typical borrowing for those seeking immediate economic help

Tips for Responsible Loaning

When taking into consideration borrowing money, it is important to come close to the process with cautious factor to consider and financial mindfulness. Here are some suggestions to ensure accountable loaning:

Assess Your Requirement: Before getting a lending, examine whether it is a need or a want. Prevent loaning for non-essential expenses.

Borrow Just What You Can Settle: Calculate your payment capacity based on your earnings and costs. Obtain just an amount that you can conveniently settle without straining your financial resources.

Understand the Terms: Check out and i was reading this comprehend the terms of the financing agreement, including rate of interest prices, costs, and settlement timetable (alberta loans). Clarify any doubts with the lender before proceeding

Compare Lenders: Study and contrast deals from various lending institutions to locate one of the most positive terms. Try to find trustworthy lenders with clear techniques.

Stay Clear Of Several Financings: Abstain from taking numerous loans concurrently as it can result in a debt spiral. Focus on paying off existing financial obligations prior to taking into consideration brand-new ones.

Final Thought

In final thought, on-line financings supply a hassle-free and fast service for immediate cash demands. By providing very easy accessibility to funds, structured application processes, and speedy authorization and disbursement, on-line financings can be a reliable option for those facing economic emergency situations. It is essential for customers to exercise accountable loaning techniques to prevent falling right into financial obligation catches and financial problems in the future.